Navigating the Complexities of Sports Car Insurance: A Comprehensive Guide

When it comes to insuring a sports car, there are various complexities and nuances that need to be understood to ensure adequate coverage and make informed decisions. This comprehensive guide will provide valuable insights into sports car insurance, covering key aspects such as coverage options, factors that impact insurance rates, and tips for finding the right policy.

Understanding Sports Car Insurance Coverage Options

Sports car insurance typically includes coverage for liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection. Each type of coverage serves a different purpose, with liability covering damages to others, collision covering damages to your vehicle in an accident, and comprehensive covering non-collision incidents like theft or vandalism. Understanding these coverage options is crucial in selecting the right policy for your sports car.

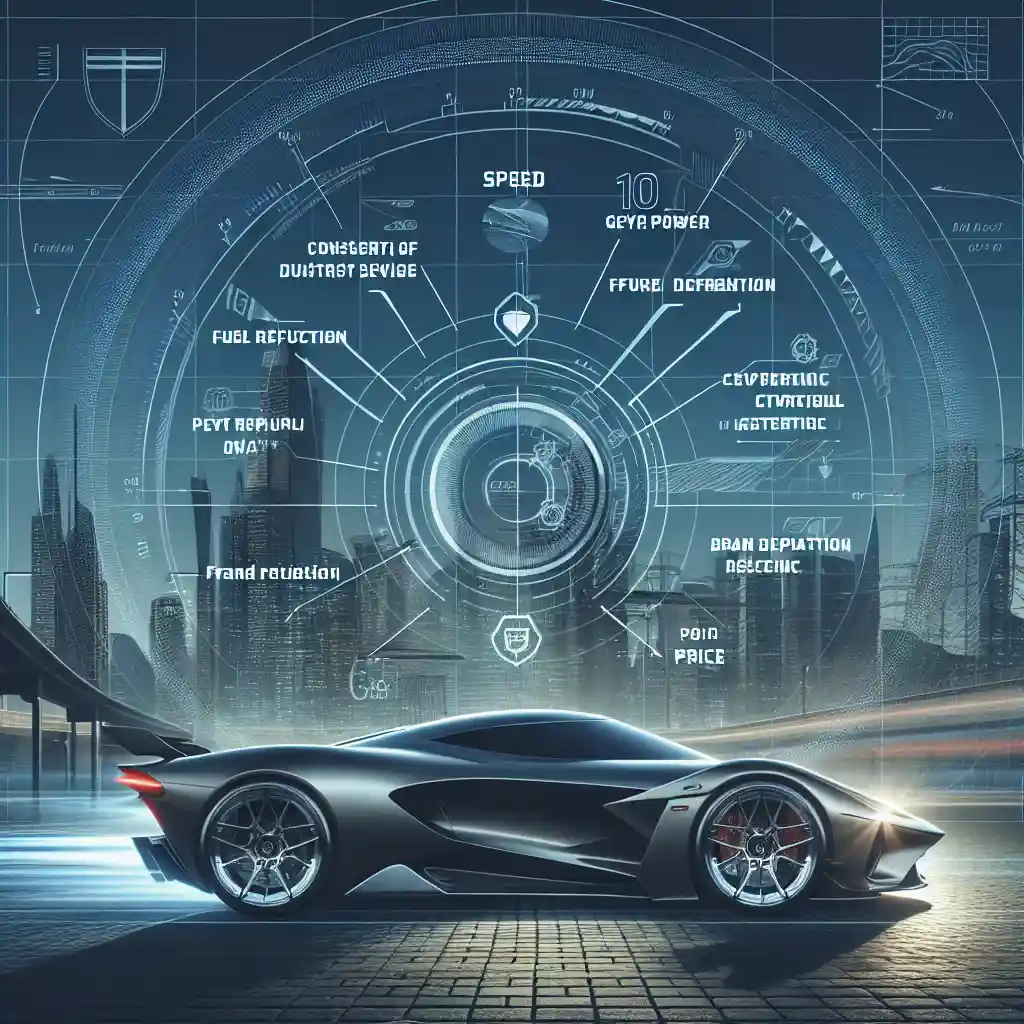

Factors Impacting Sports Car Insurance Rates

Insuring a sports car often comes with higher premiums due to factors such as the car's high value, powerful engine, and increased likelihood of speeding. Additionally, personal factors like driving history, age, and location can also influence insurance rates. For sports car owners, it's essential to be aware of these factors and take steps to mitigate risks to potentially lower insurance costs.

Tips for Making Informed Decisions About Sports Car Insurance

When shopping for sports car insurance, it's important to compare quotes from multiple providers, consider bundling policies for potential discounts, and review the coverage limits and deductibles. It's also advisable to inquire about specialized insurance options for sports cars, such as agreed value coverage or track day insurance, to ensure comprehensive protection for your high-performance vehicle.

Evaluating the Need for Additional Coverage

In addition to standard coverage options, sports car owners may want to consider additional coverage such as gap insurance to cover the difference between the car's value and the remaining loan balance in case of a total loss. Extended warranty coverage and roadside assistance plans can also provide added peace of mind for sports car enthusiasts. Assessing the need for these extra coverages is vital in safeguarding your investment.

Finding Specialized Insurance Providers for Sports Cars

While many insurance companies offer coverage for sports cars, some specialize in providing tailored solutions for high-performance vehicles. These specialized providers may have a better understanding of sports car insurance requirements and offer more customized policies to meet the unique needs of sports car owners. Researching and comparing insurance providers that cater to sports cars can help you find the most suitable coverage options.

Conclusion

Navigating the complexities of sports car insurance requires a comprehensive understanding of coverage options, factors affecting insurance rates, and considerations for making informed decisions. By delving into these key aspects and seeking specialized insurance providers, sports car owners can ensure they have the proper coverage in place to protect their prized possessions on the road. Stay informed, compare quotes, and tailor your insurance policy to suit your specific needs to enjoy peace of mind while cruising in your sports car.