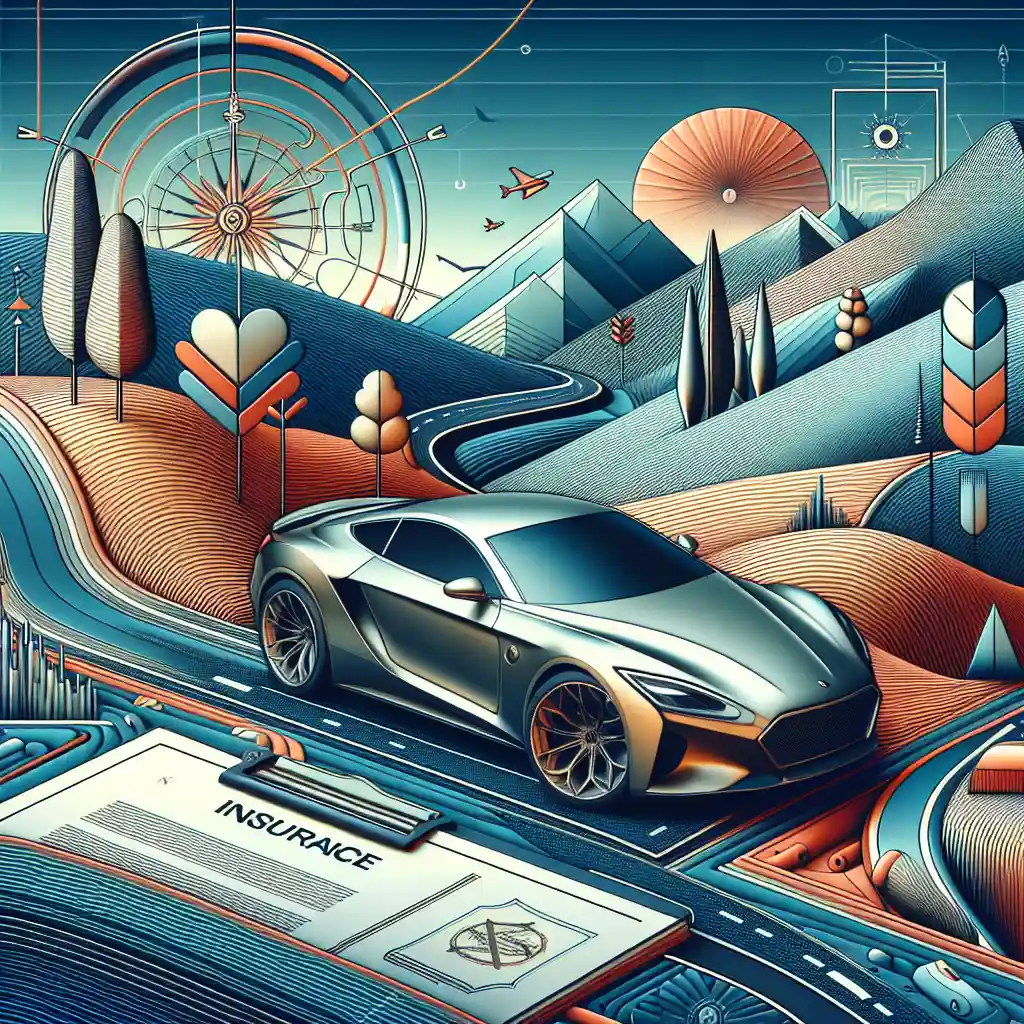

Insuring Your Sports Car: Key Factors to Consider When Choosing an Insurance Provider

When it comes to insuring your beloved sports car, selecting the right insurance provider is crucial. The right coverage can protect you and your vehicle in various situations. Let's delve into the key factors to consider when choosing an insurance provider for your sports car.

Reputation and Customer Reviews

Before settling on an insurance provider for your sports car, it's essential to research the company's reputation and read customer reviews. Look for feedback from sports car owners specifically to gauge how well the provider caters to this niche. Positive reviews indicate reliability and excellent customer service, crucial aspects when insuring a high-value asset like a sports car.

Specialized Coverage for Sports Cars

Not all insurance providers offer specialized coverage for sports cars. Ensure the provider you choose has experience insuring sports cars and offers tailored coverage options. Sports cars have unique features and higher values than regular vehicles, so having specialized coverage that considers these aspects is vital for adequate protection.

Premium Costs and Deductibles

When comparing insurance providers for your sports car, consider the premium costs and deductibles of each policy. While a lower premium may seem attractive, be sure to check what it covers and what the deductibles are. Sometimes, a slightly higher premium can offer better coverage and lower deductibles, potentially saving you money in the long run.

Additional Benefits and Discounts

Apart from standard coverage, inquire about any additional benefits or discounts offered by the insurance provider. Some companies may provide benefits like roadside assistance, coverage for track days, or discounts for safe driving records. These extras can enhance your policy and provide added value beyond basic coverage.

Claim Process and Customer Support

In the unfortunate event of an accident or damage to your sports car, a smooth and efficient claim process is essential. Choose an insurance provider known for excellent customer support and a hassle-free claim process. Quick claim resolutions and helpful customer service can make a stressful situation more manageable.

Insurance Provider's Financial Stability

Consider the financial stability of the insurance provider before making your decision. A financially stable company is more likely to fulfill its obligations and pay out claims promptly. You can check the provider's financial ratings from agencies like A.M. Best or Standard & Poor's to assess their stability.

By considering these key factors when choosing an insurance provider for your sports car, you can ensure that you have the right coverage to protect your prized possession. Remember to assess each aspect carefully and compare different providers to find the best fit for your needs. Insuring your sports car adequately is a crucial step in enjoying your driving experience with peace of mind.